And it’s nearly impossible for people of color to gain more capital and acquire a higher net worth if we don’t own assets. I think information education is the true equalizer over the long course. In order to close the racial wealth gap is through information. Is there a way to fix capitalism and make it work for both Main Street and Wall Street? The Robinhood fiasco is a symptom of capitalism, which is a system that has historically benefited the top 1% as well as wealthy white people while exploiting working-class people of color. They would have had to post a lot more capital in order to facilitate these orders. However, had Robinhood not taken action, the company may have gone out of business. The public’s perception is that Robinhood manipulated the market and transferred the wealth of power back to the hedge funds just as the smaller guy was winning. What would have happened if Robinhood decided not to react to the GameStop stock surge? People were very upset with Robinhood because it appeared that they were manipulating the market. It seemed as though Robinhood was effectively tying the hands of the small guys to protect the hedge funds. It seemed as though they were protecting Citadel and Melbourne Capital. They were only allowed to sell it, which made them feel as though Robinhood was siding with the hedge funds. This situation escalated last Thursday when traders on Reddit were not allowed to buy GameStop stocks. So, effectively to these hedge funds, their biggest enemy was the Reddit traders who were using Robinhood. Melbourne Capital was bailed out by Citadel. So Citadel is one of Robinhood’s largest clients.

Citadel is the company that Robinhood actually sells its users’ information and data (aka your “trade flow”) to. A much larger hedge fund by the name of Citadel bailed them out. The reason they were losing billions of dollars is because the stock was going up and they had to go out and purchase the shares that they borrowed at a much higher rate.Īs a result, one company by the name of Melvin Capital needed to be bailed out. If hedge funds and brokers can do this, why can’t regular people do it, too? Does Wall Street play by its own set of rules? For example, it’s literally like when you say, “you owe me like $10 million.” But because this stock is actually going the other way, you might have to post more collateral, which means you’ll actually owe $20 million or $30 million. As a result, they would have had to cover their short, meaning they would literally have had to go buy it back because the person they borrowed it from is going to require more margin. But, in this particular instance, GameStop stock just kept rising.

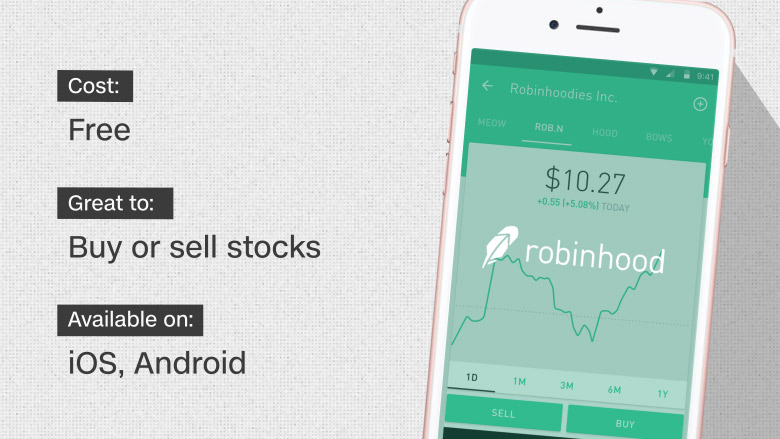

They then profit as they buy it back to actually return the shares to the people they borrowed. So anytime a hedge fund is actually shorting a company, they’re borrowing shares and sell them to someone else with the hopes that the stock goes down. And I’m going to sell it to someone else.” And the idea is, later on, if/when the stock goes down, they would buy it back for $5, and therefore earn $10 as a return of that difference. They would then go to their prime broker and say, “let me borrow these shares at $15. So, they would call their prime broker and say, “I want to borrow shares of GameStop, and sell it to someone else.”įor example, let’s say GameStop is trading at $15. In order to actually short a company, you have to borrow shares and then sell those shares to someone else in order to make a profit. The coalition of small, individual investors also ended up causing billions of dollars in losses for extremely well-funded financial firms who were betting against GameStop’s stock. As a result, shares of the struggling brick-and-mortar video game retailer jumped by more than 14,300% last week before dropping down to less than $100 as of Wednesday’s close, according to CNET. The stock saga began after a legion of retail traders banded together in the WallStreetBets forum on Reddit and decided to invest in GameStop stocks in order to make money and troll massive hedge funds. Critics say Robinhood abandoned their customers in favor of giving hedge funds and other elite investors who had shorted the stocks in the first place an unfair advantage. However, the popular free-trading pioneering app, which brands itself as a tool to help amateur traders, became the center of controversy after restricting trades on highly volatile stocks for retail investors last week. Founded in 2013, the Robinhood app revolutionized the art of investing by giving the masses the ability to buy stocks on a whim.

0 kommentar(er)

0 kommentar(er)